CDS are good, Naked CDS are bad, OK?

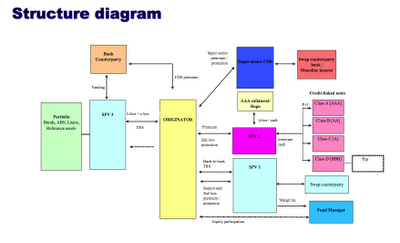

Following Barry K comment on my previous post I went and read what the FT blog had to say about the debate. The only thing bone-headed here is the coverage and the knee-jerk reaction to anything legislative. Let me see if I can give a 10 sec crash course on CDS. A credit default swap is a protection against a default of debt. If you hold a bond, you can buy "protection" against default. You pay a premium, and if the bond defaults you get the principal back. If you don't hold the bond then it is called a naked CDS. You pay the premium on a fictitious bond (you never paid the principal) but if it defaults you get paid the principal, pooof! out of bad debt, comes more bad debt. CDS are good, good in the theoretical economic value sense as it moves risk around from a party unwilling or unable to assume the risk to a party that is willing and ,again in theory, able to assume the risk (AIG anyone?). When the bond defaults, the system remains strong. This is good from a sys...