The modellers manifesto

via FT-Alphaville, a quant manifesto written by Derman and Wilmott.

They put the blame at the feet of "psychology". To me psychology plays a big role in the dynamics of money flows. Feedback loops and how strong they are, are a function of psychology, think of a bank run, or moral hazard. However the complexity is inherent in the number of variables and their connectivity. Some connections are mental, some not, all of it with real effects. Scientists in biology do not have such angst about the worthiness of mathematics. It is just another tool. A powerful, but just a tool.

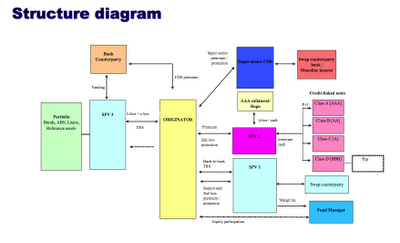

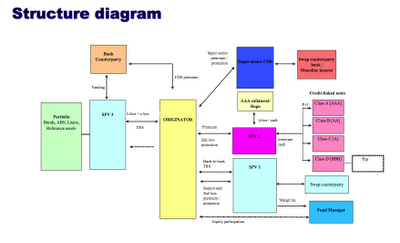

Ah yeah... remember this? The structure diagram of a CDO.

Embedded in here btw, is something that should be banned, the capacity to extract the short side of a CDS on a synthetic... these are side bets that multiply bad debt... Back to the manifesto

I really like this passage but I am afraid it will be mis-interpreted by non quants as "my gut feeling is the same as a good model". It isn't.

The problem is a belief in "one model, one size fits all" when really you need models that evolve with reality. The fact that they are fleeting and perishable is just part of the game. This isn't physics. Again, physics is a heady feeling because so much of nature obeys mathematics. As Einstein once put, "what is not understandable is that nature is understandable". Such hubris does not apply to finance. The manifesto finishes with the oath

Bah, it needs to be simpler and closer to the medical one, owing to the fact that we are dealing with a live system:

FIRST... DO NO HARM!

(banish, naked CDS on a synthetic CDO would be a corrolary)

Physics, because of its astonishing success at predicting the future behavior of material objects from their present state, has inspired most financial modeling. Physicists study the world by repeating the same experiments over and over again to discover forces and their almost magical mathematical laws. ... The method works. The laws of atomic physics are accurate to more than ten decimal places.

It's a different story with finance and economics, which are concerned with the mental world of monetary value. Financial theory has tried hard to emulate the style and elegance of physics in order to discover its own laws. But markets are made of people, who are influenced by events, by their ephemeral feelings about events and by their expectations of other people's feelings. The truth is that there are no fundamental laws in finance. And even if there were, there is no way to run repeatable experiments to verify them.

Our experience in the financial arena has taught us to be very humble in applying mathematics to markets, and to be extremely wary of ambitious theories, which are in the end trying to model human behavior. We like simplicity, but we like to remember that it is our models that are simple, not the world.

They put the blame at the feet of "psychology". To me psychology plays a big role in the dynamics of money flows. Feedback loops and how strong they are, are a function of psychology, think of a bank run, or moral hazard. However the complexity is inherent in the number of variables and their connectivity. Some connections are mental, some not, all of it with real effects. Scientists in biology do not have such angst about the worthiness of mathematics. It is just another tool. A powerful, but just a tool.

You can hardly find a better example of confusedly elegant modeling than models of CDOs.

Ah yeah... remember this? The structure diagram of a CDO.

Embedded in here btw, is something that should be banned, the capacity to extract the short side of a CDS on a synthetic... these are side bets that multiply bad debt... Back to the manifesto

We do need models and mathematics – you cannot think about finance and economics without them – but one must never forget that models are not the world. ... The most important question about any financial model is how wrong it is likely to be, and how useful it is despite its assumptions. You must start with models and then overlay them with common sense and experience.

Many academics imagine that one beautiful day we will find the ‘right’ model. But there is no right model, because the world changes in response to the ones we use. Progress in financial modeling is fleeting and temporary. Markets change and newer models become necessary. Simple clear models with explicit assumptions about small numbers of variables are therefore the best way to leverage your intuition without deluding yourself.

I really like this passage but I am afraid it will be mis-interpreted by non quants as "my gut feeling is the same as a good model". It isn't.

The problem is a belief in "one model, one size fits all" when really you need models that evolve with reality. The fact that they are fleeting and perishable is just part of the game. This isn't physics. Again, physics is a heady feeling because so much of nature obeys mathematics. As Einstein once put, "what is not understandable is that nature is understandable". Such hubris does not apply to finance. The manifesto finishes with the oath

The Modelers' Hippocratic Oath

~ I will remember that I didn't make the world, and it doesn't satisfy my equations.

~ Though I will use models boldly to estimate value, I will not be overly impressed by mathematics.

~ I will never sacrifice reality for elegance without explaining why I have done so.

~ Nor will I give the people who use my model false comfort about its accuracy. Instead, I will make explicit its assumptions and oversights.

~ I understand that my work may have enormous effects on society and the economy, many of them beyond my comprehension.

Bah, it needs to be simpler and closer to the medical one, owing to the fact that we are dealing with a live system:

FIRST... DO NO HARM!

(banish, naked CDS on a synthetic CDO would be a corrolary)

Comments