Rogoff on banking led recessions

I had read the research by Rogoff and Reinhart a couple of weeks ago forgot to blog about it and reader Thierry Janaudy resent it to me (thanks) over the weekend. Rogoff is professor of economics at Harvard.

What they do is look at historical data of economic recessions driven by financial banking crises. These are different from cyclical recessions. They study real estate impact, equity impact, unemployment, GDP, public debt and duration. It includes emerging markets because against conventional wisdom financial induced economic crises are remarkably and structurally similar.

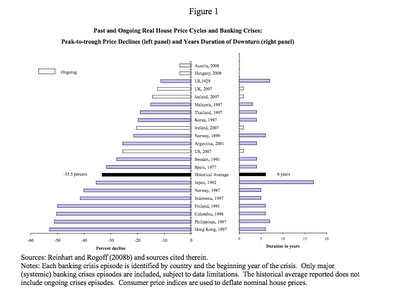

The charts speak for themselves, this is reprinted without permission so I leave them small go read the initial article for full pictures, it is an easy read as it is mostly historical data, with no analysis and models. It is also very sobering.

Below, Real estate downturn: average -35, duration 6 years (US 07: -25%, 2 years)

Below, equity downturn: average: -55%, duration: 3.5 years (US 07: -40%, 1 year)

Below, GDP downturn: average: -10 duration: 2 years (US 08: -2%, 6 month).

In terms of pure depression, 1929 was the worse with -30% GDP, we are no where close at -3%. Interesting tidbit is that equities recovery trail GDP recovery, which is inverse to common wisdom that markets will always anticipate economic recovery, not so in banking led recessions.

What they do is look at historical data of economic recessions driven by financial banking crises. These are different from cyclical recessions. They study real estate impact, equity impact, unemployment, GDP, public debt and duration. It includes emerging markets because against conventional wisdom financial induced economic crises are remarkably and structurally similar.

The charts speak for themselves, this is reprinted without permission so I leave them small go read the initial article for full pictures, it is an easy read as it is mostly historical data, with no analysis and models. It is also very sobering.

Below, Real estate downturn: average -35, duration 6 years (US 07: -25%, 2 years)

Below, equity downturn: average: -55%, duration: 3.5 years (US 07: -40%, 1 year)

Below, GDP downturn: average: -10 duration: 2 years (US 08: -2%, 6 month).

In terms of pure depression, 1929 was the worse with -30% GDP, we are no where close at -3%. Interesting tidbit is that equities recovery trail GDP recovery, which is inverse to common wisdom that markets will always anticipate economic recovery, not so in banking led recessions.

Comments

Roy, on Jan 21, they are coming to take your guns and ammo away :-)...

Better stick with the alcohol and cigarettes (and friends with guns they hid) :-)...