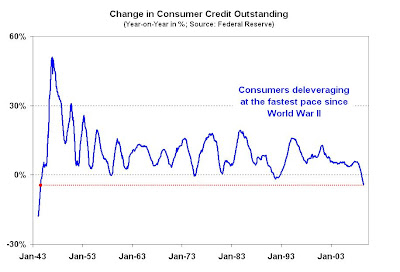

Deleveraging vs QE

Can be analyzed in terms of Friedmanism vs Keynesianism. In July consumer credit fell by 21B out of 2.5 T or an annualized rate of 10%.

From The Big Picture.

Micro-economics explains the drop, people can't find credit easily, they don't want to spend and job prospects are slim, so they deleverage.

Macro-economics explains QE, against this backdrop of disappearing debt-money the central banks are printing as much money as they can.

Deflation: 250B QE: 250B Friedman: 1 Keynes: 1. The markets look stable.

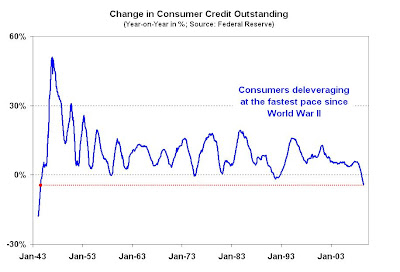

From The Big Picture.

Micro-economics explains the drop, people can't find credit easily, they don't want to spend and job prospects are slim, so they deleverage.

Macro-economics explains QE, against this backdrop of disappearing debt-money the central banks are printing as much money as they can.

Deflation: 250B QE: 250B Friedman: 1 Keynes: 1. The markets look stable.

Comments