Housing, we are not there yet

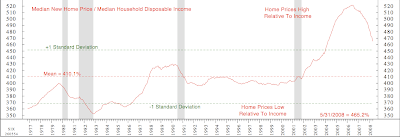

Amid horrible foreclosure data in the press this morning (and warning that the states legislation is fudging numbers by delaying foreclosure procedures), easy macro-analysis sheds some light on what is to come. Consider the "reverting to mean" that is going on above. Consider that the bell curve started in 2001, so is a very recent event, a bubble really, nothing but a bubble.

If the bubble stabilizes at +1 standard deviation, this is good news. We got 5% downside on the housing market on top of 15% so far so about $160B further damage on the banking system. Well below the FED shock absorbers. All good, we are close to bottom.

If the bubble reverts to mean, we got another 15% to go, to get back to 2001 levels. That is $1T of banking damage. At the FED shock absorbers. Bad but we might make it.

If the bubble overshoots on the way down, at -1 SD, then all bets are off. We are talking about $2T and there is nothing the FED can do. It is game over. In my opinion this scenario is a function of credit, if credit evaporates (M4) then we may be looking at an overshoot.

When a bubble can kill the system, the system deserves to die? In any case, we are not there yet, I am ignoring calls of housing bottom, it is the least plausible scenario.

Comments

In Austin, TX we had a mini-version of this bubble-bust in the 1980s. Prices fell to 80x monthly rental income (except for some exceptional property in exceptional locations). The economic conditions then were much better than now... declining interest rates, much less debt, 3% unemployment in Austin, etc...

I fully expect to be able to buy houses with 20% down (which will be the minimum except for govt loans for primary residence) in most US suburbs at this number (80x monthly income value) by 2010-11. BTW, rents will fall due to the over supply of housing (particularly oversized McMansions which probably will need to become multi-family to afford the energy bill).

80x monthly income value means that a house that will rent for $3000 will cost $240K. This will be a really good deal IF rents and the area have stablized. Normal prices are about 120x which will be where the recovery heads to.

Oh, by the way, 8% to 10% 30 year interest rates are coming back too...

The wildcard next decade for the housing "recovery" will be fuel prices and availability for civilian use. I expect this to steepen the curve, with town and city quality property recovering or stablizing quicker and exurbs becoming worth a lot less (unless said exurb is wealthy or supports some type of mining, major agricultural processing or other rural economic activity).

There was little inflation in the 2001-2006 timeframe... so these are pretty much in real terms... Also since the bench is income and income follows inflation (except now) then you factor it in.. Argument rejected.

Pierre,

a further 20% down would wreak serious havoc on the banking system. With M4 down it will be tough to recapitalize. Not sure the FED can do anything but I would expect serious backstopping action leading to the election or right after.

ut聊天室辣妹視訊

UT影音視訊聊天室

吉澤明步

QQ美女視訊秀

85cc免費影片

aa影片下載城

sex免費成人影片

aaa片免費看短片

美女視訊

sex383線上娛樂場

av969 免費短片

日本免費視訊

aa影片下載城

視訊網愛聊天室

影音視訊交友

咆哮小老鼠分享論壇

sex520免費影片

aa免費影片下載城

aio辣妺視訊

aio辣妹交友愛情館

jp成人影片

aio交友愛情館

馬子免費影片免費線上a片

18成人85cc影城0204movie

免費色咪咪視訊網pc交友

s383視訊玩美女人

34c高雄視訊聊天

jp成人

免費視訊辣妹

kk777視訊俱樂部

xxxpanda

live173影音視訊聊天室

sex520-卡通影片

成人免費視訊 完美女人

13060 免費視訊聊天

sexy girl video movie

辣妹妹影音視訊聊天室

UT視訊美女交友

視訊情色網

百事無碼a片

dvd線上aa片免費看

18禁成人網

ut聊天室kk俱樂部視訊

激情網愛聊天

情人小魔女自拍

卡通aa片免費看

夜未眠成人影城

aio性愛dvd辣妹影片直播

拓網視訊交友

視訊聊天室ggoo

168論壇視訊辣妹

love104影音live秀

美女show-live視訊情色

yam交友辣妹妹影音視訊聊天室

s383情色大網咖視訊

aaa俱樂部

台灣情色網無碼avdvd

sexy diamond sex888入口

Show-live視訊聊天室

aaaaa片俱樂部影片

aaaaa片俱樂部

dodo豆豆聊天室

sex520

網路自拍美女聊天室天堂

免費線上avdvd

援交av080影片

aa影片下載城

aaa片免費看短片

成人圖片區18成人avooo

go2av免費影片

sexdiy影城

免費線上成人影片bonbonsex

0951影片下載日本av女優

sex888免費看影片

免費視訊78論壇

辣妹有約辣妹no31314視訊

dudu sex免費影片

avdvd情色影片

免費色咪咪影片網

av080免費試看

日本美女寫真集

辣妹脫衣麻將視訊聊天室

性福免費影片分享

日本美女寫真集,kk視訊

aio交友愛情館免費成人

美女視訊

bt論壇色情自拍

免費a片卡通

tw 18 net

卡通18美少女圖

色情漫畫777美女

小護士免費 aa 片試看

百分百成人情色圖片

a片免費觀賞sexy girls get fucked

sexy girl video movie

情色文學成人小說

sex888免費看

eyny 伊莉論壇

sexdiy影城

自拍情色0204movie免費影片

aio免費aa片試看

s383情色大網咖

sexy girl video movie

草莓牛奶AV論壇

台灣論壇18禁遊戲區

環球辣妹聊天室 90691

拓網aio交友愛情館

拓網學生族視訊777美女

sex888影片分享區

hi5 tv免費影片

aa的滿18歲卡通影片

sex383線上娛樂場

sexdiy影城

免費a片線上觀看

真人美女辣妹鋼管脫衣秀

比基尼辣妹

一夜情視訊

aio交友愛情館